Bank instruments are a preferred avenue for people and enterprises to obtain funding or safe transactions for goods and services.

The SLOC guarantees that a bank will financially back the client in case they are able to’t total their product sales agreement.

These documents usually contain a formal demand from customers for payment and evidence of default. As soon as confirmed, the financial institution compensates the beneficiary up towards the SBLC’s stated sum.

The usage of devices can be a significant Software for economic price, preserving a steady economy and facilitating Worldwide trade.

SBLC monetization can influence an organization’s credit score assessment, likely altering danger implications. Analyzing the organization’s leverage and monetary stability post-monetization is crucial for an exact analysis of its credit rating score.

The whole process of SBLC monetization involves a number of strategic steps, Each individual with its important importance and requisite protocols.

Monetizing an SBLC is a fancy economical system that requires careful preparing, homework, and cooperation with economical establishments or buyers. This information will take a look at the measures involved in monetizing an SBLC.

SBLCs are commonly Utilized in domestic and international transactions where by the events to a contract don't know each other.

Utilization of Resources: The beneficiary can make use of the disbursed resources to the supposed goal, which is usually connected to the underlying organization transaction or some other purpose laid out in the monetization arrangement.

It’s crucial that you Notice that SBLC monetization also includes sure issues and concerns:

Standby Letters of Credit history (SBLC) are economical instruments that principally serve as a safeguard against default in trade and contractual agreements. When their Major purpose is to deliver assurance and security, SBLCs can be monetized to unlock liquidity and build economic prospects.

SBLC monetization might have implications with the events included, and it is important to grasp the threats related to this process. The usage of SBLC monetization ought to be meticulously considered, and events need to search for lawful and monetary advice in advance of getting into into any this sort of transaction.

Due diligence must involve a review with the terms and conditions in the SBLC, the economical strength in the issuer, plus the reputation of your monetizer. The events must also search for lawful information in order that the SBLC monetization system is lawful and complies with relevant rules and laws.

Monetizing a Standby Letter of Credit rating (SBLC) is a good fiscal tactic what is mt700 for businesses seeking to unlock liquidity with no selling property. As fiscal polices tighten in 2025, understanding the SBLC monetization process is very important for securing authentic funding.

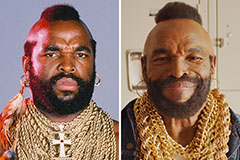

Mr. T Then & Now!

Mr. T Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!